About Project.

This project was part of the course IIMT3626 : Value-Driven Innovation. The project was divided into two parts, the first part involved choosing a B2B/B2C business and conducting user research to discover unmet customer needs. The second part involved using the research and different ideation frameworks to innovate different aspects of the business. Time duration for the project was 6 weeks.

My Role

This was an individual project with the deliverables being an essay on each of the two parts of the assignment.

History

Subway is an American fast food restaurant franchise that sells submarine sandwiches (subs) and salads. With 44,881 restaurants in 112 countries, Subway has become the largest franchising chain in the world. US being one of the most important market has 26,646 outlets. In the recent years the chain has seen a drastic drop in revenues. According to the customer loyalty ranking by Brand Keys, Subway came at last position among quick service restaurants. This shows us that there is an inherent problem in customer satisfaction and brand loyalty in the sandwich chain. To understand the fall of Subway, we first look at its rise.

There were several factors in terms of customer satisfaction that Subway got right so as to succeed in the 1990’s and further. Founded in 1965 the shop expanded to different parts of the world by aggressive franchising. This allowed Subway to capture large segments of the market quickly providing a consistent subway experience all around the world. The company’s “Eat Fresh” slogan has made the fast food chain a favorite among the more health conscious users. With the rapid expansion and growth of the fast food industry, Subway championed itself on being a customisable selection of healthy leafy sandwiches. While other fast food chains provided upscale chic environments to grab a bite, subway offered an extreme sense of personalisation and created a social annotation to the subs themselves.

If we analyze under the 4D brand model, Subway’s functional value was quick healthy fast food, social value was the healthy living associated with the sandwiches. The economic value pertained to the mid-level pricing of their healthy sandwiches, while the emotional value was the control a person got over their own food giving it a sense of freedom. This emotional value got deeply rooted as people started believing that Subway food was deliciously healthy and easily accessible.

User Research and Observations

The user research involved various interviews, card sorting activities, shadowing, immersion techniques as described in the IDEO design kit.

My research has been centered around the millennial target group i.e ages between 18 and 34. This population of 80 million has the power to influence a younger and older target groups at the same time.. The population data by euromonitor shows that the average age of the consumer is predicted to decrease in the US as well as other emerging markets, making it the most important consumer group.

The research shows that the major problem that Subway faces is the sudden change in lifestyle patterns. These expectations arise from a changing perception of the fast food industry itself along with other motivators. Fast food is regarded to be in the first phase of the maturity stage of the product life cycle indicating decline in growth rates. Subway’s healthy eat fresh campaign is failing because the definition of healthy has changed for most people. Consumers increasingly say they wish to know if their meat has been cut fresh, or their meal heated by a steamer, not microwave. This shift in perception coupled with the rise of better alternatives has led to a drift for Subway’s most loyal customer base.

The customer journey shows that the need for subway only arises when the customer is in a hurry. The brand image of Subway has become something cheap, fast and available. This gives it only a functional value but diminishes its emotional value considerably.

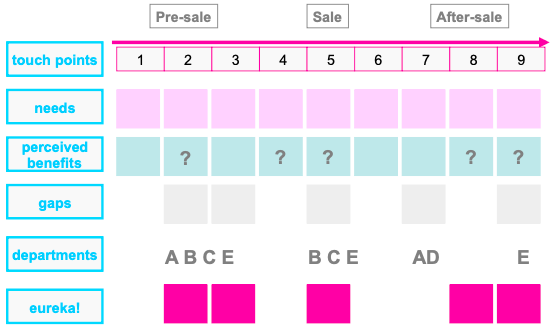

Touchpoint 1 : Discovery - Subway was found to be present in major shopping areas and commercial areas in Hong Kong however the more loyal Subway customers mentioned that the absence of a subway at every corner hinders their ability to eat Subway all the time. They cited McDonald’s as an example which was open 24 hours, available almost everywhere and offered new choices every month. This direct comparison to McDonalds appeared in various interviews where users said that they would go to Subway if it served sandwiches the way McDonald’s served its greasy burgers.

Touchpoint 2 : Space - Many users mentioned in their interviews that insufficient sitting capacities and lack of social space makes Subway unappealing to them. It often makes them feel lonely in eating their sandwich. This kind of negative emotion trickles down onto the rest of the experience as well.

Touchpoint 3 : Food - The entire process of selecting your own bread and ingredients is still exciting for most people. In fact in the user interviews, 67% of the people were satisfied with the range of choices offered by Subway. However, they still felt the value they were getting was lesser than what they were paying for. Subway has always maintained a mid level price range above its competitors like McDonalds. The 6 inch subs are not considered filling while the footlong are considered too expensive and excessive eating, thus the size of the sub has become a huge value problem for most individuals. This was noted by my shadowing as well, where people bought a 6 inch and had to buy another in some time to fill their bellies, only to waste some.

Touchpoint 4 : Customer Service - The interviews hinted towards large dissatisfaction with customer service calling them slow or inadequate. Though this experience is subjective, however researching customer reviews on Yelp shows that such dissatisfaction is prevalent in at least 3 out of the 4 outlets of Subway in Hong Kong. For the Subway’s hurried consumer, a slow or overly-chatty customer service is extremely irritating and one interviewee said it’s better if I don’t have to talk to them at all.

Touchpoint 5 : After Sales Service - Such service or followups were almost non existent, there were no promotions or loyalty memberships that Subway openly advertised. The college interviewees mentioned that they would not mind a Subway membership because it was cheap and available on Campus. However, the respondents, not in University mentioned that they wouldn’t want a membership as they had better fast food options.

In this activity users were told to imagine the restaurant as a person and describe it. It revealed some major aspects of how customers perceive Subway and its competitors.

Subway

Most people imagine Subway to be a health conscious person who goes to the gym and tries too hard to stay fit.

McDonalds

In contrast they pictured McDonald’s as an obese person who cracks a lot of jokes.

Sandwich Cafe

Respondents imagined a local sandwich cafe as an attractive girl or guy who plays the guitar.

Most people like jokes and this makes most people like fat old McDonalds. Most like listening to music and would love to hangout with the suave guitar guy. While most people are health conscious, only some find this quality attractive. Most see it as an added benefit to inherent traits that a person has unless the person is Jason Momoa. Subway’s promise of good health is not enough to attract the millennials. They have a different set of values and these values do not match with Subway’s image.

The key values of the millennials can be considered a trend now, all of them want to be famous or different or achieve something in life. Such a value system has led to a rise in independent food chains hampering Subway’s market position. Though it’s hampering fast food as a whole, chains like McDonalds having championed their low price menu still maintain a niche. Subway isn’t seen as cool by the generation, people aren’t as proud of going to Subway as they are when they go to Starbucks. With the increase in income, people are willing to spend money not just on good food but to show people that they’re eating good food. The advent of technology has brought with it the phrase “alone together” wherein people would click a picture of the food they might be eating alone. It’s this generation that coined the term foodporn, started uploading food pictures on instagram and doing check-ins when they enter a cafe. Food has become more social than ever, and Subway is lacking the most basic tenet here. It’s lonely, uncomfortable, hurried environments do not connect with the millennials.

Euromonitor analysis on Fast Food in US shows a sharp rise in independent food joints as compared to chained fast food restaurants. This was confirmed in the card sorting methods, where people chose local sandwich shop Cecilia over Subway. A cheap takeaway independent food joint can well disestablish Subway’s market, simply because people would trust it more than the Subway for taste and health both. Washington Post quotes that chain’s fast-rising rivals, like Chipotle Mexican Grill and Firehouse Subs, are beating Subway at the game it helped create, offering seemingly fresher, healthier, build-your-own meals.

Solutions

The ideas proposed are a radical break from the company’s value of consistency in experience. However with the changing lifestyle of people, this change in approach is necessary if the company wishes to survive in the fast casual environment

Subway's Mission Statement states that it aims to provide the tools and knowledge to allow entrepreneurs to compete successfully in the Fast Food industry worldwide, by consistently offering value to consumers through providing great tasting food that is good for them and made the way they want it. The company’s mission has a large focus on entrepreneurs that is the franchise owners. Subway is the only Quick Service Restaurant (QSR) which has zero company operated stores. Hence the major innovations would be focussed on the franchise system and would use the shared value creation model.

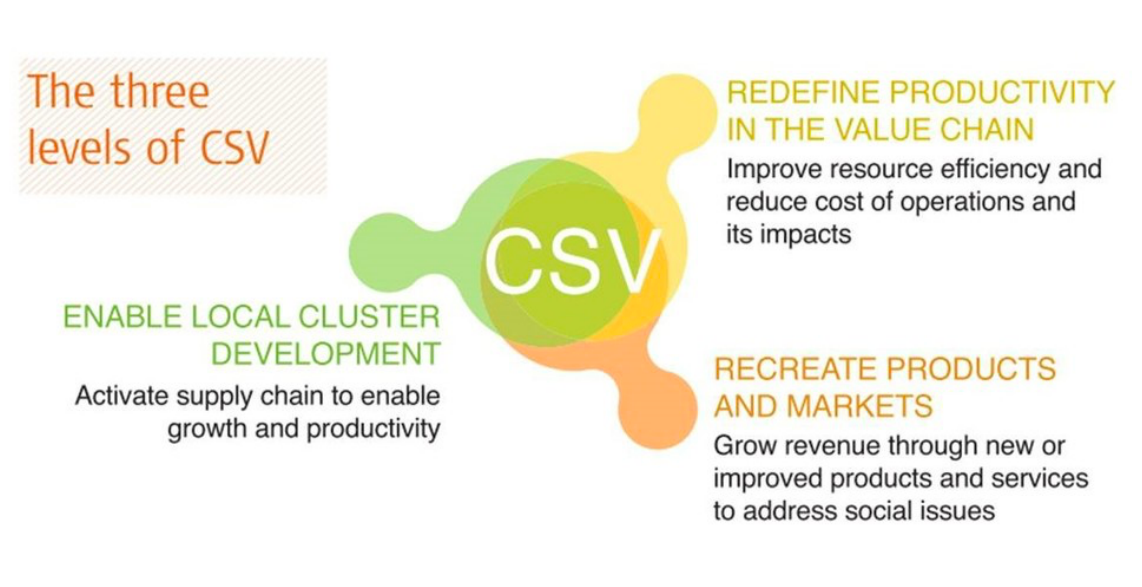

This is an innovation framework which promotes taking decisions that benefit all stakeholders of the business instead of a narrow minded focus on increasing shareholder value.

Enable Local Cluster Development - Subway has to introduce certain company operated stores to increase the rate of experimentation and bring new concepts to the market faster. Companies like McD KFC and Wendy’s all have a large portion of company operated stores which allow them to experiment. Subway having zero company stores proves to be a huge hindrance to innovation and understanding customer needs. Expertise from these company-owned stores would enable Subway to improve the operating standards for all franchises increasing their revenues. The company stores would also be a playground for testing radical ideas like Vertical Farming of ingredients or complete Vegan outlets.

Recreate Products and Markets - the current approach of Subway to adapt to local tastes and present local versions of food needs to be revamped for millennials. The Psychographic segmentation showed us how people crave for something different and unique in their dining experiences, therefore exotic flavours should be introduced. For example, instead of introducing indian curry subs in India, they should be introduced in more developed economies in North America. A major trend affecting QSR’s is globalisation, chipotle and fast chinese is working well in North America while McDonalds and KFC’s are working in China and other parts of Asia. Thus Subway should also adopt these cross market approaches to justify food choices in its vast franchisee network.

Redefine Productivity in the Value Chain - Such experimentation needs the robust franchise network we talked about earlier and also innovation in management. More and more QSR’s are moving to chef based menu’s and therefore it is important to allow for innovation in micro cuisines to be led by decentralised Subway units. With the help of different gamified mechanisms we can incentivise such production. As the mission statement states, Subway aims to help entrepreneurs thus we need to make them feel more like entrepreneurs than just small business owners. Different programs can promote this type of thinking and spirit among the franchisees. One such program is innovation challenges in the network, wherein Subway owners would be allowed to introduce two to three menu items of their own. If they manage to meet revenue targets with these new sandwiches, Subway would decrease its royalty share for the store. It follows a loose means and tight ends style of management in order to drive profitable innovation. The benefit here is that Subway can spread the new sandwich concept to other stores in the local economy to increase sales. By giving them control over their own materials and sandwiches for their new menu items, the company would give rise to these entrepreneurial franchise owners.

The main complaint of the consumers in the analysis was that Subway was very unsocial and unfriendly. This presents us a paradoxical situation as the functional value of Subway is still fast food that can be grabbed in a hurry. Instead of focussing on either aspect, it makes more sense to deal with the two different consumers with two different types of restaurants. Subway’s initial strategy of introducing Subway’s in gas stations and Airports has been a very well thought strategy for the hurried customer crowd thus these can be Subway Express stores. The more social crowd is willing to spend more for a social experience thus premium Subway Cafe’s can be opened with posh interiors and a mix of quick service as well as gourmet food . This concept is akin to McDonalds with its McCafe brand. However the difference here is that while the company integrates McCafe into a McDonalds. Subway Cafe’s would be separate units with a different functional philosophy.The Cafe concept tackles the volume problem, by keeping the prices for the gourmet food high, the gross revenue would be high too despite low volume sales. The strategy takes into account the high burnout rate for the millennial customers wherein they move onto newer locations after they get bored of a diner. By providing them a more social and posh environment we give them the feeling of a Starbucks with the value proposition of a juicy Subway Sandwich. (I recently stumbled upon the image and was not aware of Subway trying a similar concept while working on this report)

This strategy based on the view that market boundaries and industry structure are not a given and can be reconstructed by the actions and beliefs of industry players.

New fast food restaurants like SaladWorks bank on their promise for nutritious and organic food while Subway has been under the fire for its false promises on nutrition by an informed consumer market. The "Eat Fresh" image of Subway doesn’t suffice in today’s world, here comes in the Blue Ocean Strategy wherein I wish to introduce the concept of mindful dining. This concept promotes guests’ overall well-being rather than simply focusing on more nutritious menu items. The sense of personalisation that Subway offers is pushed even further when the consumers get to know where their food comes from and how it affects the environment around them. The aim of this kind of dining experience is to allow consumers to feel good about themselves while eating out and banks on sustainable food sourcing. This dining experience would definitely increase the costs of the ingredients thus it would be provided mostly in the premium Subway Cafes, however some ingredients can also be provided at the Express stores. The narrative behind where the chicken or the lettuce comes from, how it got to the store can help shift the focus from nutritional specifics to Subway’s efforts in sustainability. This taps into a unique market of customers that care about the environment and want to know how their actions affect the Earth.

Subway’s future lies in utilising its vast franchisee network to introduce new products and improve the overall Subway experience for everybody. Subway Cafes help in tackling the social value problem by providing cozy and comfortable environments for millenials to sit back and think of a caption for their next instagram post. The focus on sustainability through the Mindful Dining program breaks the cost-value tradeoff giving Subway a differentiated and unique market space that appeals to customers.